Double declining method formula

Step 1 Straight-line depreciation rate. 132 DDBA2A3A41212 First months depreciation.

Double Declining Balance Method Of Depreciation Accounting Corner

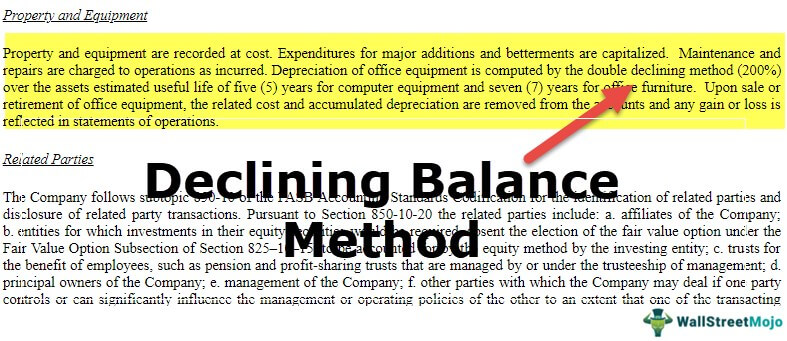

The double-declining balance method computes depreciation at an accelerated rate depreciation is highest in the first period and decreases in each successive period.

. Heres the formula for calculating the amount to be depreciated each year. Fedcorp Industries made a purchase of a delivery van to transport merchandise. Formula The formula for calculating the rate of depreciation is.

Predict an estimated useful life of the asset eg ten years. A double-declining balance records the most significant depreciation during the. Therefore the double-declining balance method depreciation for the second year will be as follows.

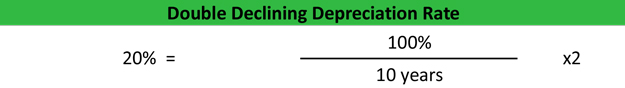

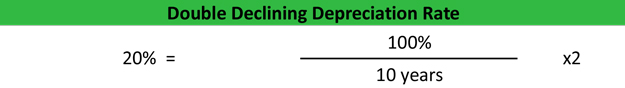

Step 2 Declining balance rate accelerated depreciation rate. The term double in the double-declining balance depreciation comes from the determining of deprecation rate to be twice of the straight-line rate. Double-declining Depreciation Rate Straight-line Depreciation Rate x 2.

50 000 x 40 20 000. Default factor is 2. To get that first calculate.

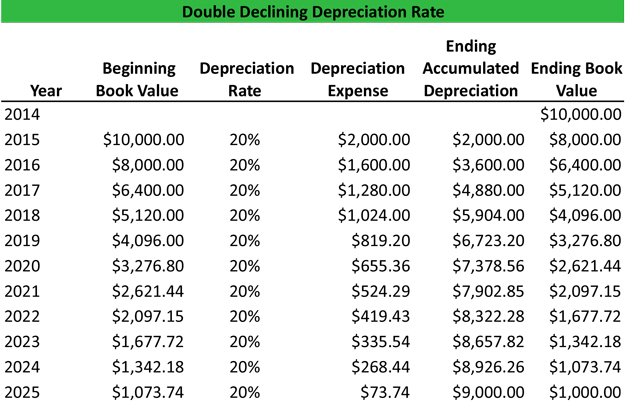

The DDB depreciation method is a little more complicated than the straight-line method. Calculate the annual depreciation rate ie 100 5 years 20. Calculate what the assets salvage value would be at.

Double declining balance rate 2 x 20 40 The book value of the vehicle at the beginning of 2010 is 50 00000 The depreciation for the first year in 2010 is therefore. The Double Declining Balance Depreciation Method Formula. 15 02 or 20.

First Year Depreciation Rate M12 x Depreciation Rate Last Year Depreciation Rate 12-M12 x Depreciation Rate Double Declining Balance Depreciation Example An asset for a business cost 1750000 will have a life of 10 years and the salvage value at. Your basic depreciation rate is the rate at which an asset depreciates using the straight line method. The double-declining balance formula is a method used in business accounting to determine an accelerated depreciation of a long-term asset.

Depreciation 2 Straight-line depreciation percent Beginning period book value As an example of how to use this suppose you purchase a 40000 car the asset for your own personal use. Step 3 calculation of depreciation expense and preparation of schedule. Formula for Double Declining Balance Method The formula for depreciation under the double-declining method is as follows.

Depreciation Opening book value of the fixed asset x Straight-line depreciation percentage x 2 Depreciation 100000 20000 x 10 x 2 Depreciation 16000. Cost of the asset recovery period. When using the double-declining balance method be sure to use the following formula to make your calculations.

The double-declining balance method computes depreciation at an accelerated rate depreciation is highest in the first period and decreases in each. Result DDBA2A3A43651 First days depreciation using double-declining balance method. Because youre subtracting a different amount every year you cant simply.

Assuming an asset has a life of five years and the declining balance rate is 150 percent the accelerated depreciation rate is 30 percent which is 100 percent divided by 5 multiplied by 15. The van purchase price is 1000. Divide 100 by the number of years in your assets useful life.

Double declining balance is calculated using this formula. To calculate depreciation using the double-declining method we need to determine the depreciation rate based on the assets useful life. Double-Declining Method Calculation Example.

Cost of asset Length of useful. The quotient you get is the SLD rate. Use the following formula to calculate double-declining depreciation rate.

To consistently calculate the DDB depreciation balance you need to only follow a few steps. Double declining depreciation method is an accelerated depreciation method where the depreciation expense decreases with the age of the asset. 2 x basic depreciation rate x book value.

MIN cost - pd factor life cost - salvage - pd where pd total depreciation in all prior periods. Gather the initial book value of the asset eg 50000. Under the straight-line depreciation method the company would deduct 2700 per year for 10 yearsthat is 30000 minus 3000 divided by 10.

Repeat the above steps until the salvage value is reached. Deduct the annual depreciation expense from the beginning period value to calculate the ending period value. Multiply the beginning period book value by twice the regular annual rate 1200000 x 40 480000.

The double declining balance formula. Companies use this formula to recalculate the annual. What is a double-declining balance formula.

20 2 40. The double-declining balance method depreciates the freezer by 600 2 x 01 x 3000 during the first year so that its book value is 2400 3000 600 at the start of the next accounting period. In other words the depreciation rate in the double-declining balance depreciation method equals the straight-line rate multiplying by two.

Annual Depreciation 2 100 Useful Life in Years. Double Declining Balance Method formula 2 Book Value of Asset at Beginning SLM Depreciation rate Wherein SLM Depreciation Rate 1 Useful life of the asset 100 Example of Double Declining Balance Method. Using the double-declining balance method however.

To calculate depreciation the DDB function uses the following formula. Fedcorp also determines that the vans will. The formula for double-declining balance is a relatively simple one.

Here are the steps for the double declining balance method. This method depreciates an asset twice as quickly as the traditional declining balance calculation. 4000 DDBA2A3A412 First years depreciation.

Prepare a depreciation schedule using double declining balance method.

Double Declining Depreciation Efinancemanagement

Depreciation Expense Calculator Online 56 Off Www Barribarcelona Com

Double Declining Balance Method Of Depreciation Accounting Corner

Double Declining Balance Method Of Deprecitiation Formula Examples

Depreciation Expense Double Entry Bookkeeping

What Is Double Declining Balance Method Of Depreciation Pmp Exam Accelerated Depreciation Youtube

/double-declining-balance-depreciation-method-4197537-FINAL-9baf4fb736b74a1686dd768332f364b3.png)

Double Declining Balance Ddb Depreciation Method Definition With Formula

Double Declining Balance Method Of Depreciation Accounting Corner

How To Use The Excel Ddb Function Exceljet

Declining Balance Method Of Depreciation Formula Depreciation Guru

Double Declining Balance Depreciation Calculator

Depreciation Formula Calculate Depreciation Expense

Simple Tutorial Double Declining Balance Method Youtube

Depreciation Formula Examples With Excel Template

What Is The Double Declining Balance Method Definition Meaning Example

What Is The Double Declining Balance Method Definition Meaning Example

Double Declining Balance Depreciation Daily Business